HCFA-1513 1986-2024 free printable template

Get, Create, Make and Sign

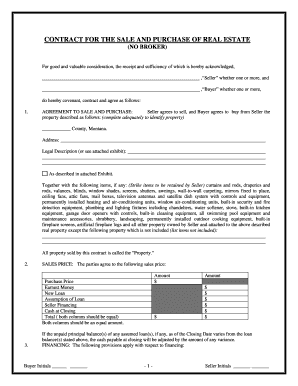

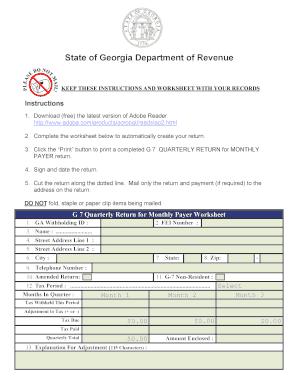

Editing property disclosure statement online

How to fill out property disclosure statement form

How to fill out property disclosure statement:

Who needs property disclosure statement:

Video instructions and help with filling out and completing property disclosure statement

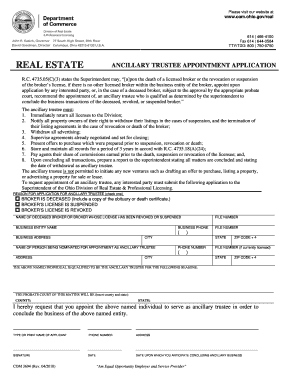

Instructions and Help about disclosure of ownership form caqh

Did you know if you're a US taxpayer living abroad and have not filed your US taxes willfully you may not be compliant with your US tax obligations, and you may be putting yourself at substantial risk? Hi, I’m Patrick Evans, founder of US TAX PRACTICE. I’m a US Certified Public Accountant based in Switzerland servicing clients here and in the rest of Europe. I'm in the business of helping fellow US Tax payers with their tax compliance and tax planning. Did you know that U.S. persons (citizens and green card holders) who are not compliant with their US individual income taxes can now take advantage of two favorable programs through the IRS? In my first video I took you through the Streamlined Compliance Procedure Program which is intended for individuals who are a non willfully were not compliant with their income tax filings. In my current video we will walk you through the Offshore Voluntary Disclosure Program which is for people who willfully evaded taxes. This program is intended for US citizens in green card holders who neglected to file their tax returns, report all income, pay their taxes and file informational returns such as (FAR’s and FATWA) due to willful conduct. This puts them at substantial risk for criminal liability and substantial civil penalties. But the good news is The Offshore Voluntary Disclosure Program also known as AVDP provides protection from criminal liability and fixed terms for several tax obligations and penalties. But in order to get the protection there are some key requirements the first thing is cooperated in the voluntary disclosure process. And secondly need to pay 20 percent penalty related to offshore income which was not reported previously this includes interest, capital gains, dividend an earned-income from foreign sources. And thirdly need to pay the normal IRS penalty which are for failing to file your tax return and failing to pay any taxes owed. Four you need to pay a penalty 27.5 percent for fifty percent in some cases of the combined balance any offshore accounts such as bank accounts, brokerage accounts foreign mutual funds or any account which is deemed to be a foreign financial account. Five need to pay all your penalties or enter a payment arrangement with the IRS and finally need to make an agreement with the IRS and agreed to cooperate with the Department of Justice related any offshore enforcement efforts. And once you sorted out the key requirements. You also need to provide the following document. Firstly payment of all tax, interest and all penalties. If you're not able to make the payment in full you need to submit your payment arrangement documentation. Two need to submit all original an amended individual income tax returns these include all 1040s and 1040 X's for the relevant years in offshore disclosure period. Three You needed to submit and complete a signed offshore voluntary disclosure letter. Four Provide all statements related to the foreign financial account this includes bank...

Fill ownership control interest : Try Risk Free

People Also Ask about property disclosure statement

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your property disclosure statement form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.